What is Walmart Stock?

Walmart Inc. (NYSE: WMT) is the stock of Walmart, a retail giant operating over 10,750 stores across 19 countries, including supercenters, warehouse clubs, and e-commerce platforms like walmart.com and Flipkart in India. Its business spans three segments: Walmart U.S., Walmart International, and Sam’s Club, offering everything from groceries to electronics at everyday low prices.

Walmart stock is a blue-chip investment, known for its resilience and consistent dividends (current yield ~0.91%). It’s listed on the NYSE, with a 52-week range of $79.76 to $107.91 as of October 2025, reflecting steady growth. For Indian investors, it’s accessible via platforms like Groww or INDmoney, making it a popular pick for global diversification.

(Image Suggestion: Walmart store exterior with its logo. Alt text: “Walmart store showcasing its global retail presence for stock analysis.”)

Why Invest in Walmart Stock?

Investing in Walmart stock offers multiple benefits:

- Stability: Walmart’s massive scale and diversified revenue (over $680 billion in FY25) provide a buffer against economic downturns.

- E-commerce Growth: With e-commerce revenue hitting $100 billion, Walmart’s digital push, including Walmart+, competes with Amazon.

- Dividends: A reliable 0.91% yield and 51 years of consecutive dividend increases appeal to income-focused investors.

- Global Reach: Its international segment, including Flipkart in India, is targeting $200 billion in revenue by 2028.

For Indian investors, Walmart stock offers exposure to a stable U.S. retail giant while hedging against rupee volatility. Use our Stock Profit Calculator to evaluate potential returns.

Financial Performance of Walmart Stock

Walmart’s financials reflect its strength. In FY25 (ended January 31, 2025), it reported $680.99 billion in revenue, up 5.6% year-over-year, with adjusted EPS of $2.51, beating guidance. Q1 FY26 saw revenue of $166 billion, up 2.5%, though net income dipped 12% to $4.5 billion due to investment losses.

Key metrics (as of October 2025):

- Market Cap: $811.96 billion

- P/E Ratio: 33.1 (forward)

- EPS: $2.64 (projected FY26)

- Dividend Yield: 0.91%

Walmart’s EBITDA of $42.48 billion and a 6.21% margin highlight operational efficiency. Its share buyback program ($7 billion repurchased in two years) boosts per-share value.

(Image Suggestion: Bar chart of Walmart’s revenue and EPS growth FY23–FY25. Alt text: “Walmart financial performance chart showing revenue and EPS trends.”)

Fundamental Analysis of Walmart Stock

Walmart’s fundamentals are robust but face challenges. Its forward P/E of 33.1 is above the S&P 500’s 23.5, signaling a premium valuation. A low beta of 0.74 indicates stability, ideal for risk-averse investors.

Pros:

- Strong cash flows from 2.1 million employees and diversified operations.

- E-commerce growth (22% globally in Q1 FY26).

- Consistent dividend growth and buybacks. Cons:

- High valuation may limit short-term upside.

- Sensitivity to tariffs, especially on Chinese imports.

- Margin pressures from e-commerce investments.

Promoter ownership is low (Walton family ~45%), but institutional holding (~35%) signals confidence. Walmart’s diversified model makes it a solid pick for long-term portfolios.

Technical Analysis of Walmart Stock

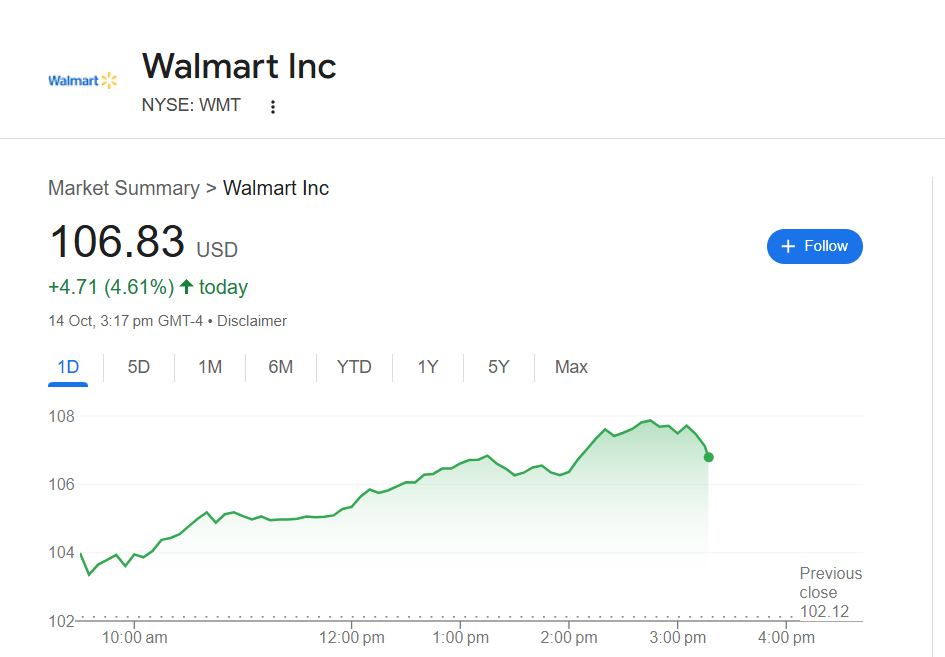

As shown in the finance card above, Walmart stock trades at $106.88 (October 2025), near its yearly high of $107.91. It’s up 75% over the past year, outperforming the S&P 500. Technical indicators include:

- 50-Day Moving Average: ~$101.59

- 90-Day Moving Average: ~$101.78

- RSI: Neutral (~55), suggesting no overbought conditions.

- Support: $101.75 (recent low); Resistance: $108.57.

The stock shows bullish momentum but faces resistance near $110. A breakout could push it toward analyst targets, while a pullback to $101 offers a buying opportunity. Use our Stock Profit Calculator to simulate trades.

(Image Suggestion: Candlestick chart from finance card above. Alt text: “Walmart stock price chart with moving averages and RSI for October 2025.”)

Walmart Stock Price Forecast: 2025–2030

Analyst forecasts for Walmart stock vary, reflecting optimism tempered by valuation concerns. Below are projections based on recent data:

| Year | Low Target ($) | High Target ($) | Average Target ($) |

|---|---|---|---|

| 2025 | 89.09 | 115.99 | 105.60 |

| 2026 | 98.66 | 120.00 | 110.00 |

| 2027 | 107.68 | 134.00 | 125.00 |

| 2028 | 129.71 | 221.00 | 175.00 |

| 2029 | 72.18 | 337.00 | 142.07 |

| 2030 | 52.31 | 204.99 | 140.00 |

- 2025: Consensus suggests $111.30, a 5.97% upside from $106.88, driven by e-commerce and stable demand.

- 2030: Optimistic forecasts reach $200, assuming e-commerce and international growth, though bearish views cite tariff risks.

Long-term, Walmart’s digital transformation and private-label strength could drive a $1 trillion valuation by 2030, per some analysts. Use our Future Value Calculator to project returns.

Expert Opinions on Walmart Stock

Analysts are largely bullish, with 30 of 39 rating WMT a “Strong Buy” and an average 12-month target of $114.89 (12.81% upside). Morgan Stanley ($115) and UBS ($110) highlight Walmart+ growth, while Goldman Sachs notes tariff risks.

The Motley Fool suggests Walmart may underperform the S&P 500 due to its high P/E, recommending buys on pullbacks. CoinCodex sees steady growth to $129.71 by 2028, but bearish forecasts warn of a potential dip to $86.42 if tariffs hit margins. Indian investors should weigh these against rupee-dollar fluctuations.

Risk Factors for Walmart Stock

Investing in Walmart stock carries risks:

- Tariffs: Potential 100% tariffs on Chinese imports could raise costs, impacting margins.

- Valuation: A forward P/E of 33.1 is above its five-year average of 31, risking corrections.

- Economic Slowdowns: U.S. consumer spending weakness may slow growth.

- Competition: Amazon and regional players challenge e-commerce dominance.

- Currency Risk: For Indian investors, USD-INR volatility adds uncertainty.

Mitigate these by diversifying and using tools like our Average Share Price Calculator to track entry points.

How to Use the Average Share Price Calculator for Walmart Stock

For Indian investors buying Walmart stock at different prices (e.g., $100 and $110), our calculator simplifies tracking your average cost. Input each trade’s quantity and price (convert INR to USD if needed). For example:

- Buy 10 shares at $100 ($1,000).

- Buy 5 shares at $110 ($550). Total cost: $1,550. Total shares: 15. Average: $103.33.

This helps assess profits when selling (e.g., at $106.88) and supports tax reporting under India’s LTCG rules. Try it free at Aurexa Finance.

Aurexa Finance: Your Free Stock Tools Hub

Aurexa Finance is your go-to for free, reliable tools to master global investing:

- SIP Calculator: Plan systematic investments in stocks or ETFs.

- CAGR Calculator: Measure Walmart’s historical 7% annualized growth.

- Stock Profit Calculator: Calculate gains from Walmart trades.

- Future Value Calculator: Project long-term returns to 2030.

Our mission, “Where Wealth Meets Intelligence,” ensures Indian investors have data-driven insights to build wealth confidently in global markets like Walmart stock.

SEO-Focused FAQs Section

What is the current price of Walmart stock?

As of October 2025, Walmart stock (WMT) trades at $106.88, as shown in the finance card above.

Is Walmart stock a good investment in 2025?

With a “Strong Buy” rating from 30 analysts and a 12-month target of $114.89, Walmart is attractive, but its high P/E suggests waiting for pullbacks.

What is the forecast for Walmart stock in 2030?

Analysts predict a range of $52.31–$204.99, with an average of $140, driven by e-commerce and international growth.

How do I calculate my average cost for Walmart stock?

Use the formula: Total Cost / Total Shares. For example, 10 shares at $100 and 5 at $110 = $1,550 / 15 = $103.33. Try our free Average Share Price Calculator.

Can Indian investors buy Walmart stock?

Yes, via platforms like Groww or INDmoney, with LRS limits up to $250,000 annually. Convert INR to USD and monitor forex risks.

Does Walmart stock pay dividends?

Yes, it offers a 0.91% yield ($0.94 annually), with 51 years of consecutive increases.

Conclusion

Walmart stock (WMT) combines stability, growth, and dividends, making it a strong choice for Indian investors eyeing U.S. markets. Despite risks like tariffs and high valuations, its e-commerce surge and global expansion signal long-term potential. Use our free Average Share Price Calculator to track your investments and make informed decisions.

Start today with Aurexa Finance—where your wealth meets intelligence. Calculate your Walmart stock average now.