Implied volatility (IV) is a critical driver of option prices, reflecting the market’s expectation of future price swings in the underlying stock. Higher IV increases option premiums, as it signals greater potential for price movement, boosting the chance of an option expiring in-the-money. Conversely, lower IV reduces premiums, making options cheaper but less likely to yield large gains. Top traders leverage IV to time trades, buying options when IV is low for potential expansion and selling when IV is high to capture inflated premiums. Understanding IV’s impact allows traders to optimize strategies, manage risk, and maximize profits in the dynamic options market of 2025.

What Is Implied Volatility?

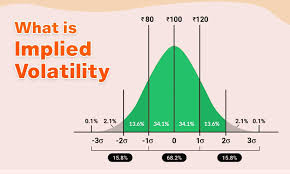

Implied volatility is a measure of the market’s expectation of how much an underlying asset’s price will fluctuate over the life of an option, expressed as an annualized percentage. It’s derived from an option’s current market price using models like Black-Scholes and reflects the collective sentiment of traders about future uncertainty. Unlike historical volatility, which looks backward, IV is forward-looking, making it a dynamic indicator of market expectations.

Key Characteristics of IV

Impact on Premiums: Higher IV increases option prices (premiums), as it suggests larger potential price swings, raising the likelihood of an option expiring in-the-money (ITM). Lower IV decreases premiums, reflecting reduced expected movement.

Applies to Calls and Puts: IV affects both call and put options equally, as volatility increases the value of potential price movements in either direction.

Dynamic Nature: IV fluctuates based on market conditions, events (e.g., earnings reports, economic data), and supply-demand dynamics for options.

Vega Connection: IV’s impact is measured by the Greek Vega, which quantifies how much an option’s price changes for a 1% change in IV. For example, a vega of 0.20 means the option’s price rises $0.20 for a 1% IV increase.

Why IV Matters

IV is a core component of an option’s price, alongside the stock price, strike price, time to expiration, and interest rates. It reflects market sentiment—high IV signals uncertainty (e.g., before an earnings report), while low IV indicates stability. Top traders use IV to gauge whether options are overpriced or underpriced, timing trades to exploit mispricings.

For example, if a stock like Tesla (TSLA) at $350 has a call option with a high IV of 50%, the option is priced for significant movement, making it expensive. If IV drops to 30% post-event, the option’s price falls, even if the stock price remains unchanged. Understanding this dynamic is crucial for profitable trading.

How Implied Volatility Affects Option Prices

IV directly influences an option’s premium, as it reflects the market’s perception of future risk. Here’s a detailed breakdown of its impact:

1. Higher IV Increases Option Premiums

When IV rises, option prices increase because the market expects larger price swings, boosting the probability of the option expiring ITM. This applies to both calls and puts:

Call Options: A higher IV increases the chance the stock price will exceed the strike price, raising the call’s value.

Put Options: Similarly, higher IV enhances the likelihood of the stock falling below the strike price, increasing the put’s value.

For example, a $100 strike call on a $100 stock with a vega of 0.25 sees its price rise by $1 if IV jumps from 20% to 24%. This is why options are pricier during volatile periods, like before earnings or economic announcements.

2. Lower IV Decreases Option Premiums

When IV falls, option prices drop, as the market anticipates smaller price movements, reducing the chance of profitability. This phenomenon, known as “IV crush,” often occurs after high-volatility events (e.g., earnings reports), when uncertainty resolves, and IV plummets.

For instance, if a stock’s IV drops from 40% to 20% post-earnings, a $100 strike put with a vega of 0.30 loses $6 in value, even if the stock price doesn’t move. This can erode profits for option buyers but benefits sellers who collect high premiums before the drop.

3. IV’s Impact Across Option Types

In-the-Money (ITM) Options: Have lower vega, as their intrinsic value is less affected by volatility. However, IV still influences their extrinsic (time) value.

At-the-Money (ATM) Options: Have the highest vega, as their value is purely extrinsic and highly sensitive to IV changes.

Out-of-the-Money (OTM) Options: Also have high vega, as their value depends entirely on the potential for large price moves driven by volatility.

4. IV and Time to Expiration

IV’s impact is magnified for options with longer expirations, as there’s more time for volatility to affect the stock price. Long-dated options have higher vega, making them more sensitive to IV changes. Conversely, options near expiration have lower vega, as time decay (theta) dominates.

Example

Consider a $50 stock with a $50 strike call (ATM) expiring in 30 days:

IV = 20%, Vega = 0.20, Option Price = $2.00

If IV rises to 25%, the price increases to $2.00 + (5 × 0.20) = $3.00

If IV falls to 15%, the price drops to $2.00 – (5 × 0.20) = $1.00

This shows how IV swings can significantly alter option prices, independent of stock price changes.

The Role of Implied Volatility in Trading Strategies

Top traders use IV to design strategies that capitalize on its impact. Here’s how IV shapes key approaches:

1. Buying Options in Low-IV Environments

When IV is low (e.g., during stable market periods), options are cheaper, offering a cost-effective entry for directional or speculative trades. Traders buy calls or puts expecting an IV increase, which boosts premiums. For example:

Pre-Earnings Trades: Buy options before earnings when IV is low, anticipating a spike as uncertainty grows. A straddle (buying a call and put at the same strike) benefits from both IV expansion and stock movement.

2. Selling Options in High-IV Environments

High IV inflates option premiums, making it ideal for selling strategies like covered calls, cash-secured puts, or credit spreads. Sellers collect high premiums, profiting if IV drops post-event (IV crush). For example:

Covered Calls: Sell OTM calls with high IV to maximize premium income, as the option’s value erodes with declining IV.

Iron Condors: Sell OTM calls and puts with high IV, benefiting from time decay and IV contraction.

3. Volatility-Based Strategies

IV drives strategies designed to profit from volatility changes, regardless of stock direction:

Long Straddle/Strangle: Buy ATM or OTM calls and puts to profit from large price moves or IV spikes. Ideal for events like earnings or product launches.

Short Straddle/Strangle: Sell ATM or OTM calls and puts to collect high premiums when IV is expected to drop, risking losses if the stock moves significantly.

4. Hedging with IV

Traders use IV to hedge portfolios:

Protective Puts: Buy puts with moderate IV to protect stock holdings, balancing cost with downside protection.

Vega-Neutral Strategies: Combine options with offsetting vega values to minimize exposure to IV changes, focusing on delta or theta instead.

Example

Before an earnings report, you expect high volatility for Amazon (AMZN) at $180. You buy a $180 straddle (call + put) with a vega of 0.40. If IV rises from 30% to 40%, the straddle’s value increases by $4 per option ($8 total), even without stock movement. Post-earnings, you sell to capture the IV-driven gain.

Actionable Tip: Use IV percentile (IVP) to gauge whether IV is high or low relative to the past year. Buy options when IVP is below 20, sell when above 80.

How Top Traders Use IV for Profits

The top 5% of traders leverage IV to optimize trades and manage risk. Here’s their approach, with practical steps:

1. Timing Trades with IV Percentile

Top traders compare current IV to historical levels using IV percentile or rank:

Low IV (IVP < 20): Buy options (calls, puts, or straddles) expecting IV to rise, increasing premiums. For example, buy a $100 call on a $100 stock with low IV before a catalyst.

High IV (IVP > 80): Sell options to capture inflated premiums, anticipating IV crush. Sell OTM puts on a stable stock like Coca-Cola (KO) during high-IV periods.

Actionable Tip: Use platforms like Thinkorswim or Barchart to track IVP and set alerts for extreme levels.

2. Exploiting IV Crush

After high-IV events (e.g., earnings), IV often drops sharply, reducing option prices. Top traders:

Sell options before the event to collect high premiums, closing positions post-event to profit from IV crush.

Avoid buying options post-event, as IV contraction erodes value.

Example: Sell a $65 call on KO at $60 with IV at 40% before earnings, collecting $2. Post-earnings, IV drops to 20%, and the option’s price falls to $0.50, yielding a $1.50 profit.

3. Balancing IV with Other Greeks

IV interacts with Delta, Gamma, and Theta:

Delta and IV: High IV increases delta for OTM options, making them more sensitive to stock price changes. Traders adjust delta exposure during IV spikes.

Gamma and IV: High IV amplifies gamma for ATM options, increasing delta volatility. Traders monitor gamma to avoid unexpected risk.

Theta and IV: High IV offsets theta’s time decay in long-dated options, while low IV accelerates theta’s impact near expiration.

Actionable Tip: Use a Greeks calculator to assess IV’s interplay with other metrics before entering trades.

4. Risk Management

Position Sizing: Limit vega exposure to 1–2% of account risk. A high-vega position can lead to large losses if IV moves against you.

Hedging IV Risk: Use vega-neutral strategies (e.g., calendar spreads) to offset IV changes, focusing on delta or theta profits.

Stop-Losses: Exit long option positions if IV drops significantly, signaling reduced profit potential.

5. Real-World Example

In 2025, you’re trading NVIDIA (NVDA) at $120 before a product launch. IV is low (25%, IVP = 15). You buy a $120 straddle with a vega of 0.30, costing $5 ($500 per contract). If IV rises to 35% and NVDA moves $10, the straddle gains $3 from IV ($0.30 × 10) and $6 from delta, yielding a $400 profit ($9 – $5 × 100). To hedge, sell an OTM strangle to reduce vega exposure.

By mastering these techniques, top traders turn IV into a profit driver, balancing opportunity with discipline.

Practical Tools and Resources for IV Trading

In 2025, technology simplifies IV analysis. Here’s a toolkit for success:

Trading Platforms

Thinkorswim: Tracks IV, IVP, and Greeks in real-time, with strategy simulators.

Interactive Brokers: Offers IV charts and options chains with volatility filters.

Tastytrade: Tailored for options traders, with IV-focused analytics.

Analytical Tools

OptionStrat: Simulates IV changes and strategy outcomes.

Barchart: Provides IVP and historical volatility data.

CBOE Volatility Index (VIX): Tracks market-wide IV, useful for gauging sentiment.

Data Sources

Yahoo Finance: Monitors earnings and events driving IV spikes.

Bloomberg: Real-time IV data for stocks and indices.

Economic Calendars: Track events (e.g., Fed meetings) impacting IV.

Educational Resources

Option Volatility and Pricing by Sheldon Natenberg for in-depth IV analysis.

Online courses on Udemy or Coursera covering volatility and options.

Follow traders on X for real-time IV strategies and market insights.

Actionable Tip: Use a demo account to practice IV-based trades, testing strategies like straddles or credit spreads for 3–6 months.

Common Pitfalls to Avoid with IV

Even savvy traders can misjudge IV. Here’s how to avoid traps:

1. Buying During High IV

Purchasing options when IV is high (e.g., IVP > 80) risks losses from IV crush post-event. Check IVP before buying.

2. Ignoring IV Crush

Holding long options after high-IV events leads to value erosion. Exit or roll positions before IV drops.

3. Neglecting Other Greeks

Focusing solely on IV ignores delta, gamma, and theta. High IV can offset theta but amplify gamma risk.

4. Misreading IV Levels

Assuming high IV always means overpriced options is a mistake. Compare IV to historical levels and upcoming catalysts.

5. Overcomplicating Strategies

Complex strategies (e.g., condors) require precise IV management. Start with simple trades like single calls or puts.

By avoiding these pitfalls, you ensure IV enhances your trading success.

Case Studies: IV in Action

Let’s explore real-world scenarios to see how top traders use IV:

Case Study 1: Pre-Earnings Straddle

You’re trading Apple (AAPL) at $200 before earnings, with IV at 20% (IVP = 10). You buy a $200 straddle with a vega of 0.35, costing $6. If IV rises to 30% and AAPL moves $10, the straddle gains $3.50 from IV ($0.35 × 10) and $5 from delta, yielding a $250 profit ($8.50 – $6 × 100).

Case Study 2: Selling High-IV Options

Coca-Cola (KO) at $60 has an IV of 40% (IVP = 85) before a dividend announcement. You sell a $65 call with a vega of 0.20, collecting $2. Post-announcement, IV drops to 20%, reducing the option’s price to $0.50, yielding a $1.50 profit.

Case Study 3: Hedging with IV

Your portfolio holds 100 shares of Microsoft (MSFT) at $400 (delta = 100). With IV high before a Fed meeting, you buy a $380 put with a vega of 0.30 and delta of -0.40, costing $3. If IV drops post-event, the put loses $1.50 (IV from 35% to 30%), but delta protects against a stock drop, balancing risk.

These cases show IV’s role in driving profits and managing exposure.

Building an IV-Focused Trading Plan

To become a top trader using IV, integrate it into a structured plan:

Assess IV Levels: Use IVP to identify low (buy) or high (sell) IV opportunities.

Select Strategies: Choose IV-driven strategies like straddles for low IV or credit spreads for high IV.

Manage Risk: Limit vega exposure to 1–2% of account risk. Hedge with vega-neutral spreads.

Monitor IV: Track IV daily using platform tools. Adjust positions if IV shifts unexpectedly.

Backtest and Journal: Test IV strategies in a demo account, recording outcomes and IV impacts.

Actionable Tip: Start with simple IV trades (e.g., selling OTM puts in high-IV environments) before progressing to complex strategies like straddles.

The Broader Context: IV in 2025’s Market

In 2025, IV is shaped by unique market dynamics:

AI and Tech Volatility: Stocks like NVIDIA and Tesla have high IV due to rapid innovation and market speculation.

Economic Events: Interest rate decisions, inflation data, and geopolitical shifts drive IV spikes across sectors.

Crypto Crossovers: Options on crypto ETFs (e.g., Bitcoin ETFs) exhibit extreme IV, offering opportunities for volatility traders.

Top traders stay ahead by monitoring sector-specific IV trends and leveraging AI-driven tools to predict IV shifts. For example, platforms like Trade Ideas use machine learning to forecast IV based on historical patterns.

Conclusion: Harnessing IV for Trading Success

Implied volatility is a cornerstone of options trading, driving premiums and shaping strategies. By understanding how IV affects option prices, top traders time trades, exploit mispricings, and manage risk effectively. Whether buying in low-IV environments, selling during IV peaks, or hedging with vega-neutral strategies, IV offers a path to consistent profits. In 2025, with advanced tools and real-time data, mastering IV is more accessible than ever. Start small, practice diligently, and let implied volatility guide you toward the top 5% of traders. The market rewards those who understand its nuances—make IV your edge.