As an Expert , Analysts remain cautiously optimistic on Tata Motors in 2025. The consensus 12-month target is ₹823, implying 21% upside. JPMorgan holds a Neutral rating with ₹740, citing JLR headwinds, while 30 analysts average a "Hold" with potential for upgrades on EV milestones. Equitymaster highlights pros like debt reduction but warns of short-term weakness. Overall, experts see Tata Motors as undervalued for patient investors targeting 2030 horizons

In the dynamic world of Indian stock markets, Tata Motor stands as a powerhouse in the automotive sector, driving innovation amid electric vehicle (EV) transitions and global expansions. As investors eye long-term growth, the Tata Motors share price target 2030 remains a hot topic, fueled by the company’s ambitious EV goals and robust fundamentals. At Aurexa Finance, we specialize in delivering transparent, data-driven insights to help Indian investors, traders, and finance learners navigate opportunities like these. This comprehensive analysis delves into Tata Motors’ performance, valuation, and future projections, drawing on the latest 2025 data to forecast potential returns. Whether you’re a seasoned trader or a budding investor, understanding these trends can sharpen your portfolio strategy in a market projected to see EV penetration hit 30% by decade’s end. With shares trading around ₹679 as of October 2025, the question on every mind is: Can Tata Motors sustain its momentum to reach ambitious targets by 2030? Let’s break it down step by step.

Company Overview

Tata Motors Limited, a flagship of the Tata Group, is India’s largest commercial vehicle manufacturer and a global leader in passenger vehicles. Established in 1945, the company has evolved into a multinational powerhouse, producing a diverse portfolio that includes cars, trucks, vans, buses, and luxury brands through subsidiaries like Jaguar Land Rover (JLR). Its product lineup spans affordable hatchbacks like the Tiago to premium SUVs such as the Harrier and Safari, alongside electric models like the Nexon EV, which dominates India’s EV market.

In the commercial segment, Tata Motor leads with reliable trucks and buses tailored for logistics and public transport. The industry it operates in—the automotive sector—is undergoing a seismic shift toward sustainability, with Tata Motors committing to 30% EV sales penetration ahead of its 2030 target. Globally, it exports to over 125 countries, bolstered by JLR’s premium offerings. This blend of domestic strength and international reach positions Tata Motors as a resilient player in a ₹10 lakh crore industry, focusing on smarter, safer mobility solutions.

(Image Suggestion: A collage of Tata vehicles including Nexon EV and JLR models. Alt text: “Tata Motors product lineup featuring EVs and commercial vehicles for 2025 overview.”)

Financial Performance

Tata Motor has demonstrated resilient financial growth despite market headwinds, with a 37.2% CAGR in profits over the past five years. Fiscal Year 2025 (FY25) marked record revenues, driven by passenger vehicle market share gains to 13.9% and EV sales momentum. However, Q1 FY26 showed a slight dip due to seasonal factors and global supply chain issues.

Here’s a snapshot of key financial metrics:

| Fiscal Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) |

|---|---|---|---|

| FY23 | 3,45,967 | 2,610 | 7.50 |

| FY24 | 4,02,000 | 2,900 | 8.40 |

| FY25 | 4,39,700 | 3,500 | 10.10 |

Revenue growth reflects strong domestic demand and JLR’s recovery, while EPS improvements signal efficient cost management and debt reduction.

Fundamental Analysis

Tata Motors’ fundamentals underscore its undervaluation in 2025, with an intrinsic value estimated at ₹799—38% above the current price of ₹679. Key valuation ratios include a P/E of 15.2x (below industry average of 18x), P/B of 3.1x, and ROE of 18.5%, reflecting solid profitability.

Promoter holding stands at 42.57%, providing stability, while institutional investors hold 25%. Pros include EV leadership, diversified revenue (60% from passenger vehicles), and a 75.9% three-year profit CAGR. Cons: Exposure to volatile commodity prices and JLR’s luxury market sensitivity, with recent debt levels at 0.8x EBITDA.

Overall, these metrics suggest Tata Motors is a compelling long-term hold for value investors.

Technical Analysis

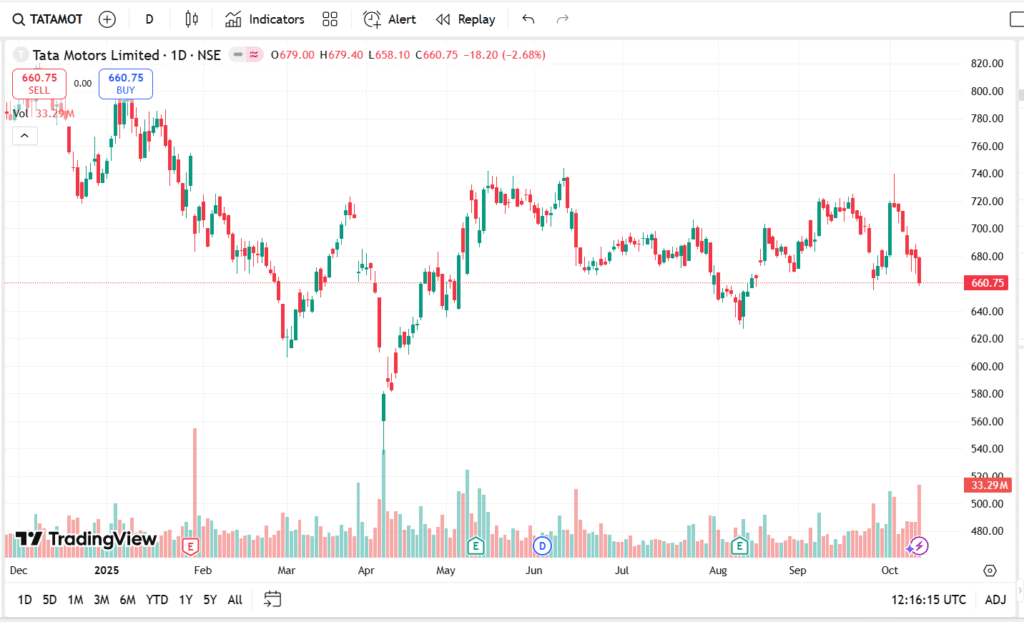

As of October 2025, Tata Motors stock trades at ₹679, down 5.19% weekly amid broader market corrections. The chart reveals a falling trend channel in the medium term, with prices below the 50-day SMA of ₹696 and 200-day SMA of ₹720. RSI(14) at 44.21 indicates neutral to oversold conditions, while MACD shows a bearish crossover at -0.84.

Support levels hover at ₹650 (recent low), with resistance at ₹709. A breakout above ₹709 could signal reversal, but current indicators lean toward “Strong Sell.” Volume has spiked on down days, suggesting caution for short-term traders.

(Image Suggestion: Candlestick chart of Tata Motors stock with RSI and moving averages overlaid. Alt text: “Technical analysis chart for Tata Motors share price in October 2025 showing trend channel and indicators.”)

Share Price Target

Projections for Tata Motors share price target 2030 vary based on EV adoption and global recovery, with analysts forecasting 3-5x upside from current levels. Our data-driven estimate factors in 15% annual CAGR in revenues, driven by 30% EV mix.

| Year | Low Target (₹) | High Target (₹) | Average Target (₹) |

|---|---|---|---|

| 2025 | 800 | 1,000 | 900 |

| 2026 | 1,000 | 1,200 | 1,100 |

| 2027 | 1,500 | 1,800 | 1,650 |

| 2028 | 2,000 | 2,500 | 2,250 |

| 2029 | 2,500 | 3,200 | 2,850 |

| 2030 | 3,000 | 4,000 | 3,500 |

By 2030, targets could reach ₹3,500 if execution aligns with plans.

Expert Opinions

Analysts remain cautiously optimistic on Tata Motors in 2025. The consensus 12-month target is ₹823, implying 21% upside. JPMorgan holds a Neutral rating with ₹740, citing JLR headwinds, while 30 analysts average a “Hold” with potential for upgrades on EV milestones. Equitymaster highlights pros like debt reduction but warns of short-term weakness. Overall, experts see Tata Motors as undervalued for patient investors targeting 2030 horizons.

Risk Factors

Investing in Tata Motors carries inherent uncertainties:

- Market Volatility: Recent 42% peak-to-trough decline in 2025 amid boardroom issues and demerger.

- EV Competition: Intensifying rivalry from Maruti and global players could erode market share.

- Global Exposure: JLR’s luxury segment is sensitive to economic slowdowns and chip shortages.

- Regulatory Shifts: Stricter emission norms and subsidy changes may impact costs.

- Currency Fluctuations: Rupee volatility affects exports and imports.

Mitigate with diversification and monitoring quarterly updates.

Conclusion

Tata Motors’ journey toward a ₹3,500 share price target by 2030 hinges on EV dominance, financial discipline, and strategic expansions—offering substantial potential for Indian investors. While technicals signal near-term caution, strong fundamentals and analyst backing paint a bullish long-term picture. At Aurexa Finance, we’re committed to empowering you with such data-backed analyses to build resilient portfolios. Stay informed and invest wisely.

FAQs

What is the expected Tata Motors share price in 2025?

Analysts project an average of ₹900, with a range of ₹800-₹1,000, based on EV growth and market recovery.

Is Tata Motors a good long-term investment for 2030?

Yes, with projected 3-5x returns if EV targets are met, though risks like competition warrant caution.

What drives Tata Motors’ growth prospects?

Key drivers include 30% EV penetration by 2030, JLR recovery, and domestic SUV demand.

How does Tata Motors’ valuation compare to peers?

At 15.2x P/E, it’s undervalued versus the industry’s 18x, signaling buy potential.

What recent event impacted Tata Motors stock?

The 2025 demerger and boardroom turmoil led to a 1.7% dip, but long-term outlook remains positive.